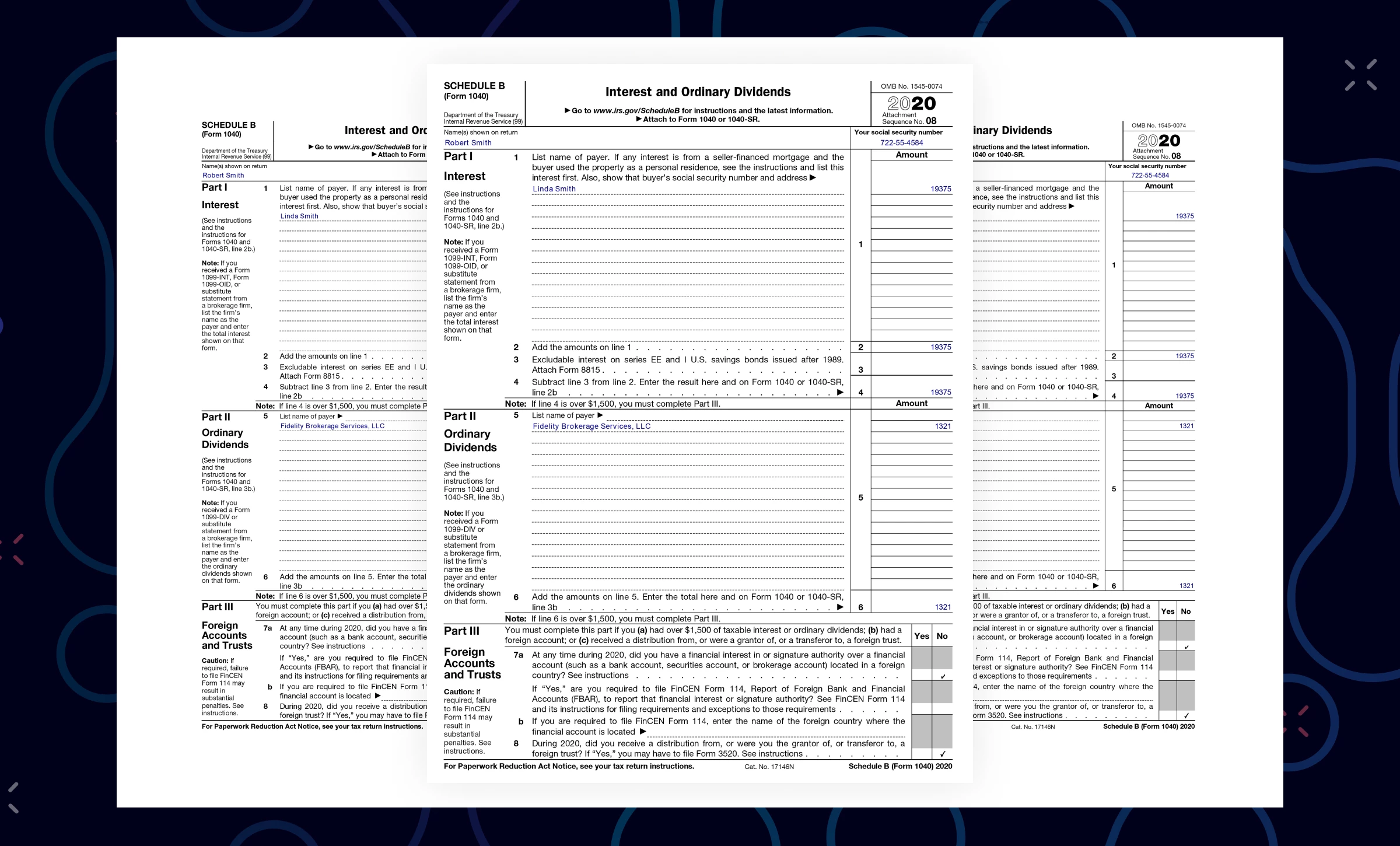

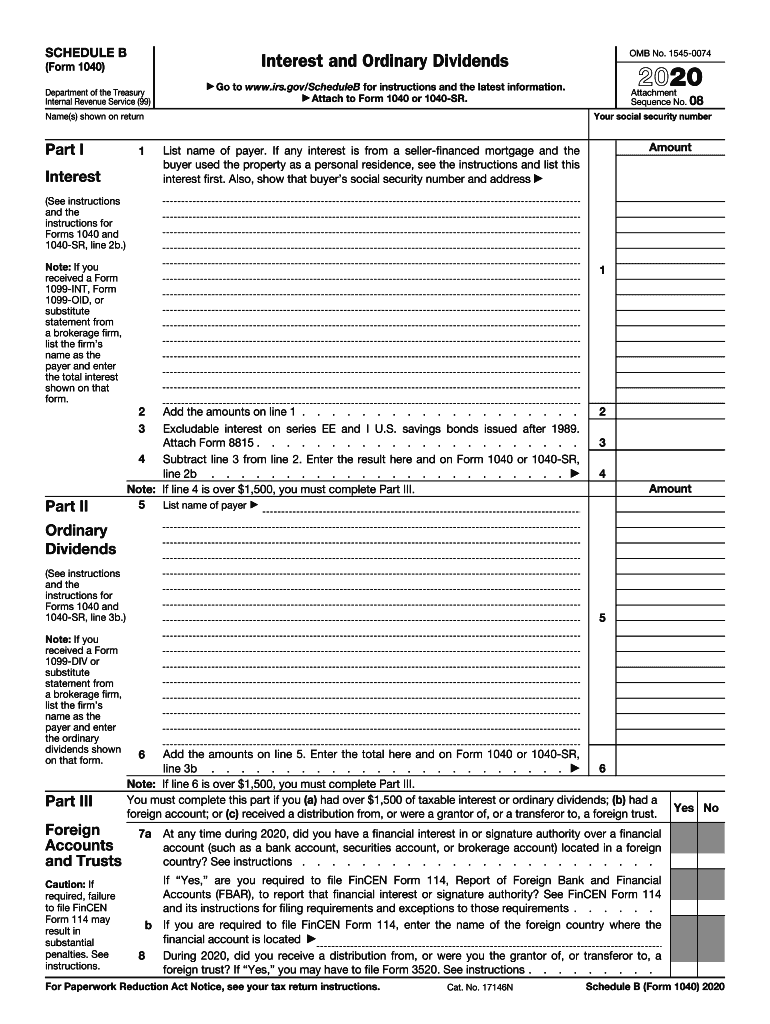

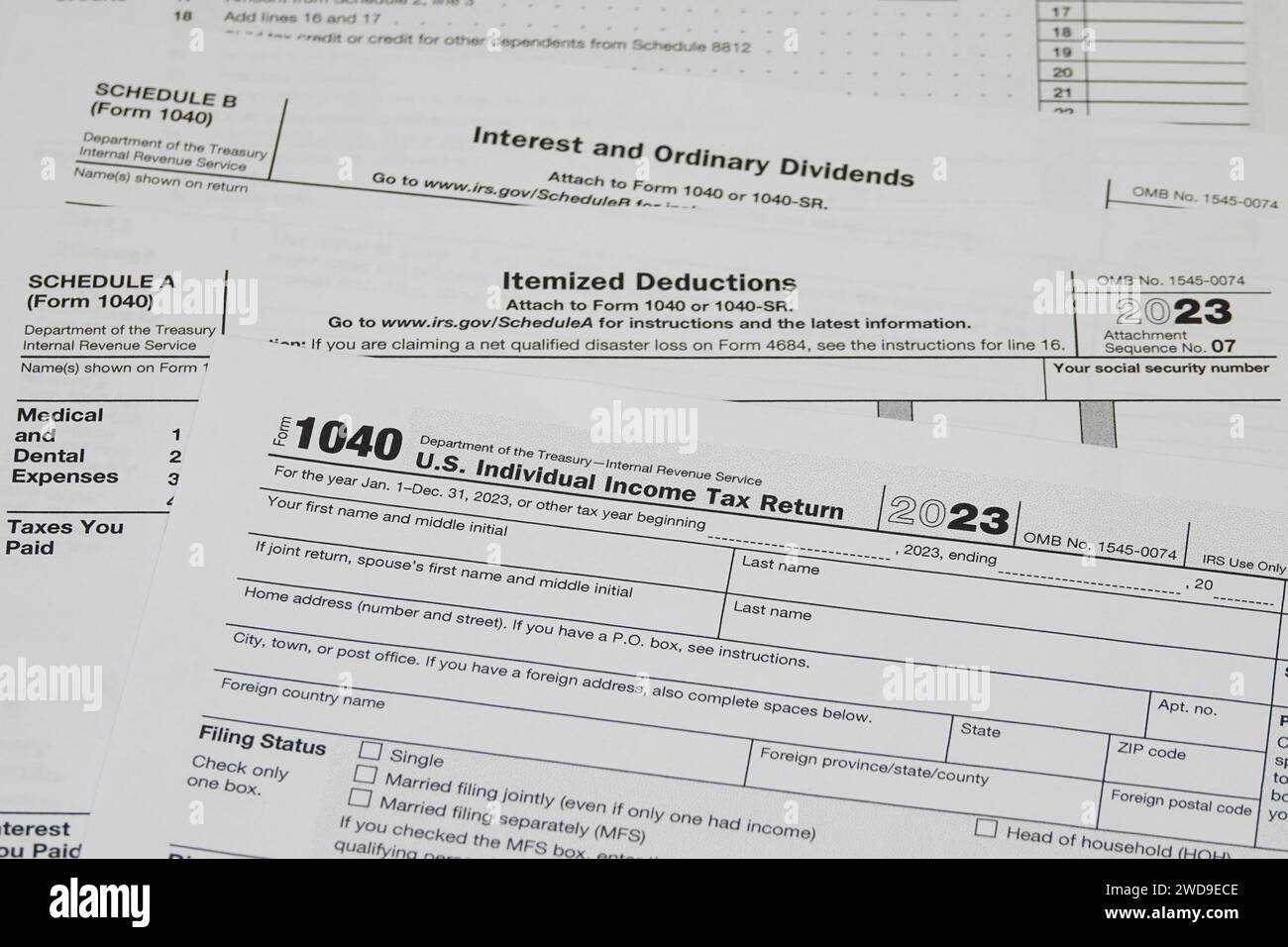

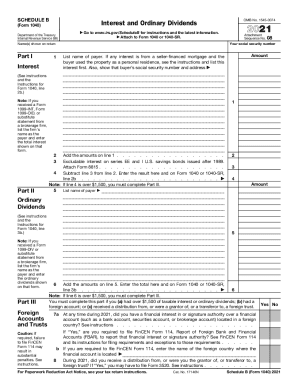

2024 Schedule B Form 1040 – Use the amount from Line 2 of Schedule B (Form 1040) instead. Nontaxable interest is reported on Line 2a of your federal return (Form 1040). This includes interest on municipal bonds. Tax-exempt . If the total taxable interest exceeds $1,500, you must complete Part I of Schedule B of IRS Form 1040. For CDs cashed out prior to maturity, the Form 1099-INT and/or Form 1099-OID will report the .

2024 Schedule B Form 1040

Source : www.ocrolus.comB104 Form 1040 & 1040 A Schedule B Interest and Ordinary

Source : www.nelcosolutions.comSchedule b: Fill out & sign online | DocHub

Source : www.dochub.comIrs Schedule B for 2018 2024 Form Fill Out and Sign Printable

Source : www.signnow.comSchedule b: Fill out & sign online | DocHub

Source : www.dochub.comItemized deductions hi res stock photography and images Alamy

Source : www.alamy.comIRS Schedule B (1040 form) | pdfFiller

Source : www.pdffiller.com2023 Schedule B (Form 1040)

Source : www.irs.gov2021 schedule b form 1040: Fill out & sign online | DocHub

Source : www.dochub.comSchedule B on Form 1040

Source : www.yumpu.com2024 Schedule B Form 1040 IRS Form 1040 Schedule B 2020 Document Processing: You will report capital gains and dividend income — and losses — on Form 1040. If you claim more than $1,500 in taxable dividends, you will also have to file Schedule B (Form 1040). . Your 1040 will come with a number of schedules – like Schedule 1 and Schedule he says you might receive a 1099-K form if you engage in high-volume trading; a 1099-B if you show gains or .

]]>