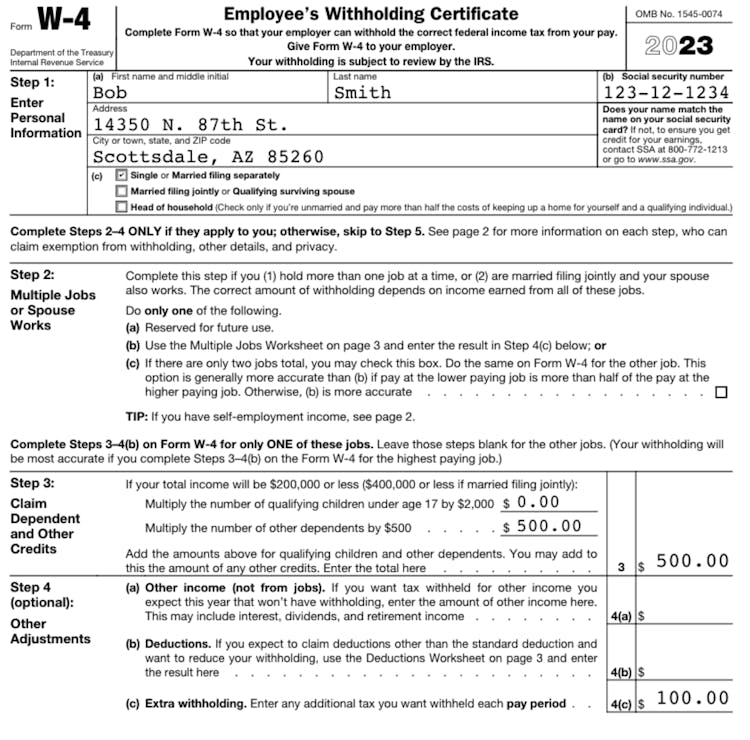

New W-4 Forms For 2024 Monthly – A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer an updated version of Form W-4 for 2024, which can be used to adjust withholdings on . When you start a new job, you’re required to complete an IRS Form W-4, which is used to determine know how much money you can spend each month on rent, groceries, dinners out and other .

New W-4 Forms For 2024 Monthly

Source : www.irs.govIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.com2024 Form W 4P

Source : www.irs.govHow to Fill Out the W 4 Form (2024) | SmartAsset

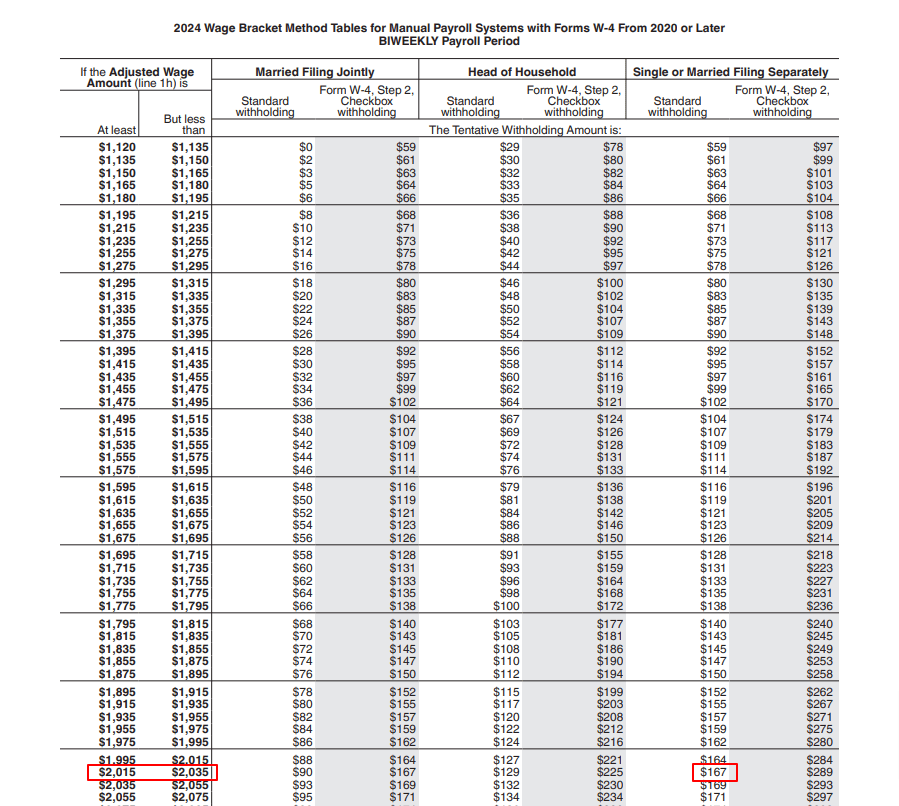

Source : smartasset.comHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comForm W 4 2023 (IRS Tax) Fill Out Online & Download [+ Free Template]

Source : www.pandadoc.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govGuide to Additional Amount Withheld and Form W 4 | Indeed.com

Source : www.indeed.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comForm W 4 2023 (IRS Tax) Fill Out Online & Download [+ Free Template]

Source : www.pandadoc.comNew W-4 Forms For 2024 Monthly Employee’s Withholding Certificate: As we enter the 2024 proxy season resulted in a restatement that triggered a clawback analysis; and new Item 402(w) of Regulation S-K requiring certain disclosures in Forms 10-K and proxy . Please refer to the Management Tools for instructions for managing hourly employee payroll. Federal income tax is calculated based on IRS tax tables and selections made on Form W-4. State and local .

]]>