New Withholding Tables For 2024 Social Security – But don’t worry if you’re not quite sure where you stand for either the 2023 or 2024 tax year—you’ve come to the right place. I’ll lay out the seven tax brackets and rates for both years in . These Social Security checks should reflect the new 3.2% cost-of-living adjustment (abbreviated COLA) for 2024. That’s lower than last year’s historic 8.7% increase, but still above average .

New Withholding Tables For 2024 Social Security

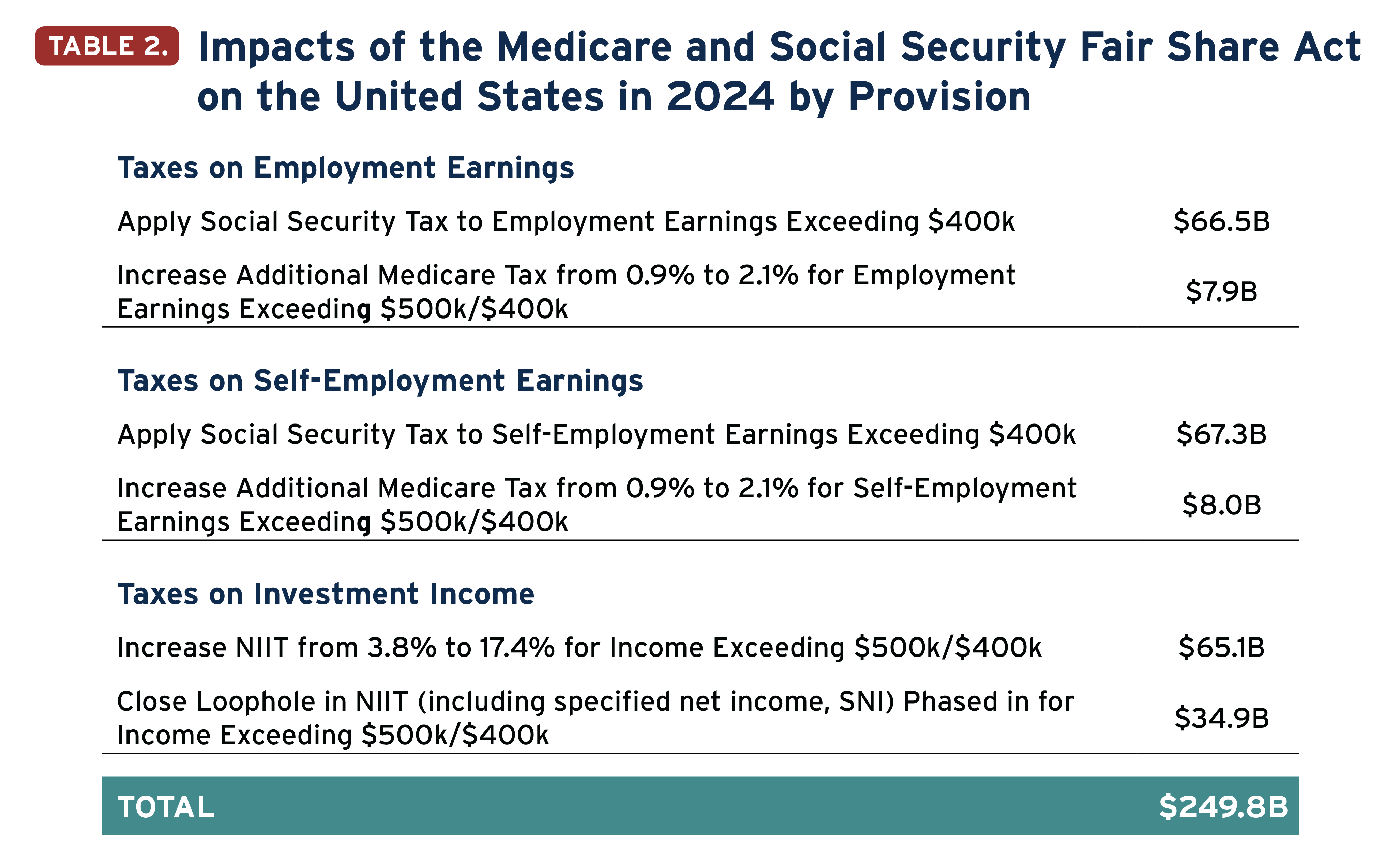

Source : www.uzio.comFair Share Act’ Would Strengthen Medicare and Social Security

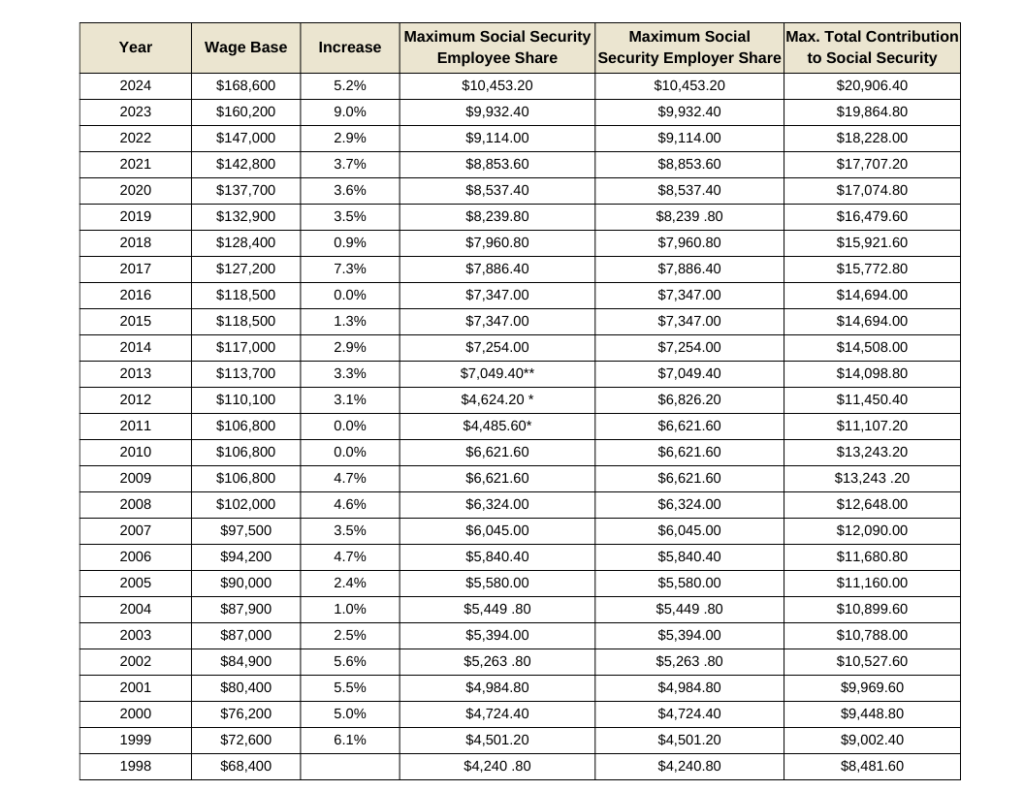

Source : itep.orgPaying Social Security Taxes on Earnings After Full Retirement Age

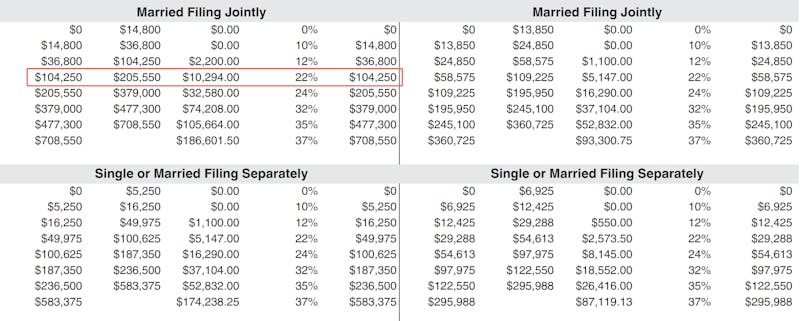

Source : www.investopedia.comHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comSocial Security COLA Increase Set at 3.2% for 2024

Source : www.aarp.orgPayroll Tax Rates (2024 Guide) – Forbes Advisor

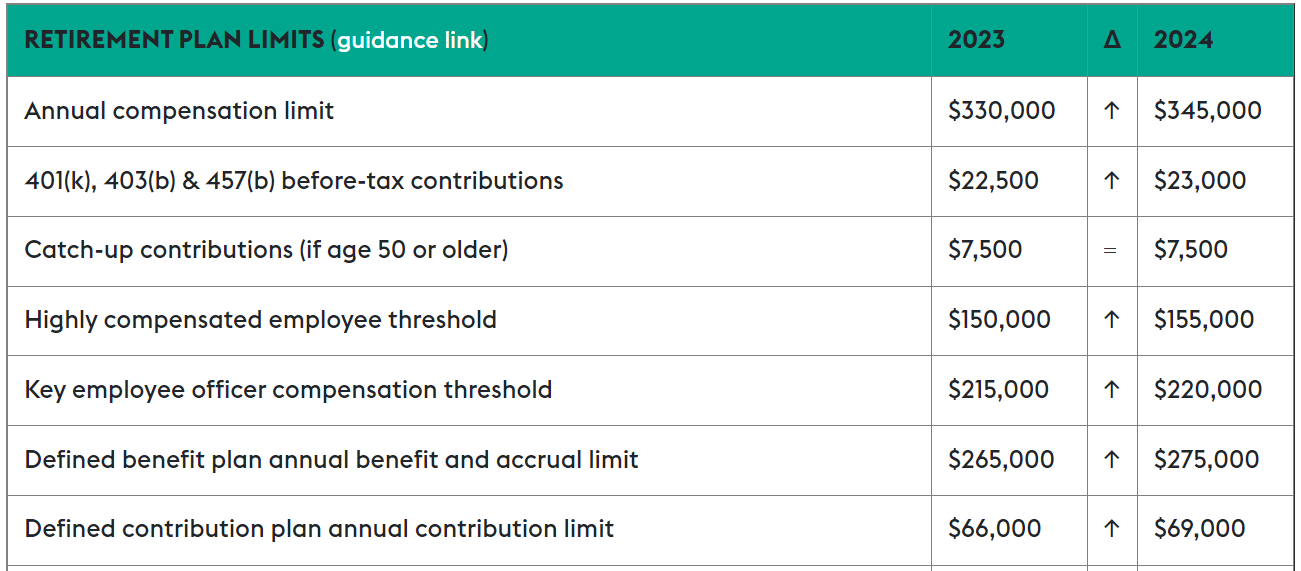

Source : www.forbes.comIRS Announces 2024 Employee Benefit Plan Limits Lexology

Source : www.lexology.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2024 Payroll Tax & Form 941 Due Dates

Source : www.paylocity.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgNew Withholding Tables For 2024 Social Security Social Security Wage Base 2021 [Updated for 2024] UZIO Inc: Legislatures across the nation are confronting several social issues including crime, drug use, immigration and poverty. These issues will continue to hold resonance, of course, in the November . Check out our top recommendations for human capital management software that can streamline your HR processes and improve workforce management. .

]]>

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)